Us pin code: Free zip code finder & lookup by State, City & Address

What is a zip code? Definition and examples

The zip code is a system the United States Postal Service uses to identify a location and route the mail to that specific location. Zip stands for Zoning Improvement Plan.

Originally, the US Post Office used a 5-digit zip code. It subsequently expanded it to nine digits. With nine digits, it can carry out a more detailed identification.

Even though the 5-digit zip code is still enough for sending postal items, the 9-digit code is used mainly for businesses. Businesses can get a discount if they use the 9-digit code.

The US Post Office says the following about its zip code system:

“During World War II, thousands of experienced postal employees left to serve with the military. To offset the loss, in May 1943 the Post Office Department began a zoning address system in 124 of the largest cities.”

“Under this system, delivery units or zones were identified by one or two numbers between the city and state — for example, Birmingham 7, Alabama — so that mail could be separated by employees who did not have detailed scheme knowledge. ”

”

“Twenty years later, the Department implemented an even farther-reaching plan, the Zoning Improvement Plan (ZIP) Code.”

This US Postal Service web page helps businesses find zip codes. There are several ways you can access this information.

The US Postal Service has been using a Zip Code system since 1963.

Zip code – what do digits represent?

The first digit generally represents a group of US states. The second and third digits determine the central mail processing facility that processes and sorts the mail. We also call this facility the ‘sec center’ (sectional center facility).

All letters and parcels with the same first three digits go to the same sec center. The sec center subsequently sorts them according to the last two digits, after which they go to local post offices.

For example, let’s look at the zip code 88310. The first digit – 8 – represents the national area. ‘Eight’ covers Arizona, Colorado, Idaho, New Mexico, Nevada, Utah, and Wyoming.

The next two digits – 83 – represent the Sec Center. The last two digits – 10 – represent the delivery area or associate post office.

Zip code equivalents in other countries

In the UK, the post office uses a system it calls the ‘post code,’ which is alphanumeric. Alphanumeric means it consists of numbers and letters. In the British System, for domestic properties, a single postcode may cover up to one-hundred properties in contiguous proximity.

We can write the term as one word – postcode – or two words – post code.

Ireland, which has the Eircode, provides a 7-character alphanumerical unique code for each individual address.

India has had PIN codes since 1972. PIN stands for Postal Index Number. It is a six-digit code. India has nine different postal zones.

The Canadian postal code consists of six characters, which are alphanumeric.

Australian post codes consist of four numbers. You have to write them after the name of the town, city, or suburb, and the state or territory.

In New Zealand, post codes consist of four digits.

While Americans say zip code, most other countries say post code, postal code, or pin code.

post-code-search – Google Suche

AlleMapsShoppingNewsBilderVideosBücher

Suchoptionen

Postcode Finder – Find an Address | Royal Mail Group Ltd

www.royalmail.com › find-a-postcode

Use Royal Mail’s Postcode and Address Finder to search for any UK address or postal code. Simply type part of the address for a list of suggestions.

Chwiliwr Cod Post · Tell us now · Email this address

PLZ-Suche – Deutsche Post Direkt

www.postdirekt.de › plzserver › PlzSearchServlet

05.03.2018 · POSTLEITZAHLENSUCHE · Find postal code by address: · Find town by postal code: · Find P. O. box: · Find major recipient: · Advanced search:.

O. box: · Find major recipient: · Advanced search:.

Germany Postal Code Lookup – Find postcode – Europacco

www.europacco.com › … › Find postcode

Bewertung 4,4

(9.813)

Here you can find info on the structure of the postcodes and addresses of Germany. Our postcode search provides the postcodes, open Europacco now!

Search for a postal code in Germany – World Postcodes

www.worldpostcodes.info › germany

Find a postcode in Germany and display it on a map. … You can use this page to search for postal codes in Germany. If you’re looking for postal codes in …

World Postal Code – free zip/postal code lookup

worldpostalcode.com

Use our postal code lookup for every country around the world. Complete list of zip codes and all administrative divisions for countries.

Zip/Postal Code Lookup by Address, City, State

worldpostalcode. com › lookup

com › lookup

Find any zip code (including ZIP+4 – full 9-digit US zip codes) or postal code in the world by using our simple lookup function. Enter the address, city, …

Find a Postal Code – Canada Post

www.canadapost-postescanada.ca › postalcode › fpc

Find a postal code for an address in Canada. Look up postal codes online.

Ähnliche Fragen

How do I find a UK postcode?

How can I find my postal code?

What is a German postcode?

What is a 5 digit postcode?

Germany Postal Code Lookup by Address/City, Map (Zip code …

postalcode.globefeed.com › Germany_Postal_Code

Lookup Germany Postal Code/Zip Code/Postcode of Address, Place & Cities in Germany. Germany Postal Code Map will display the nearby searched postal codes.

Postcode & Address Finder for UK – Parcelforce Worldwide

www.parcelforce.com › Receiving a parcel

We use cookies to help give you the best possible experience on our site: 1. “Strictly necessary” and “functional” cookies support site navigation, search, …

“Strictly necessary” and “functional” cookies support site navigation, search, …

Postcode Search & Finder – Australia Post

auspost.com.au › postcode

Australia Post postcode finder is a quick and easy way to search and find postcodes for all towns and suburbs in Australia.

Ähnliche Suchanfragen

Postal code

UK postcode London

Postal code Germany

UK postcode finder

Postal code – Deutsch

UK postcode list

Postcode finder Deutschland

International postal code Germany

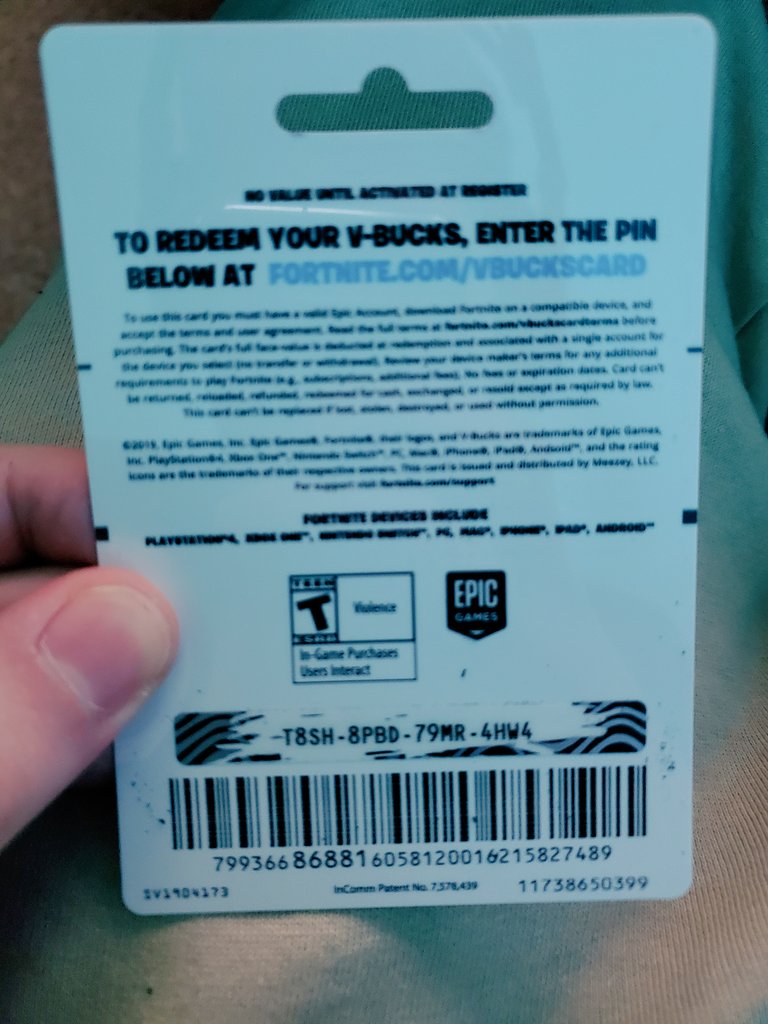

Security measures – Payment cards

Security measures when using payment cards

1. General security measures and risk minimization

1.1. Upon receipt of the Card, be sure to put your signature on it.

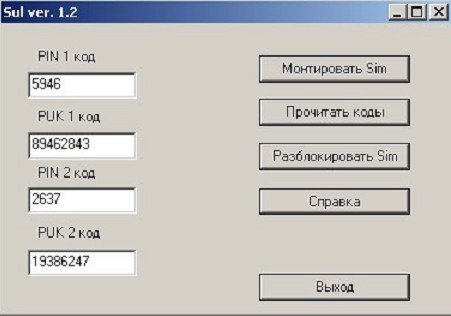

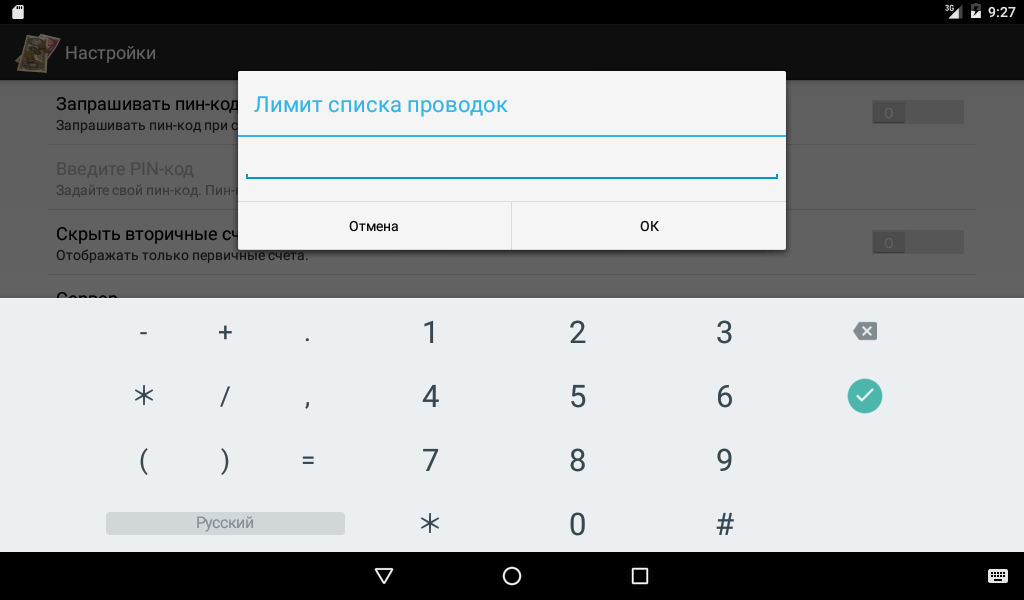

1.2.PIN code (Personal Identification Number) is a combination of numbers containing 4 characters and designed to identify the Card holder and protect against unauthorized use of the Card.

Information about the PIN-code should be known only to you. No one has the right to ask you to provide the PIN code of the Card.

1.3. Do not store the PIN code and the Card together, do not write down the PIN code on the Card itself.

Remember the PIN code, or keep it separately from the Card in a place inaccessible to others

.

1.4. Do not give the Card to third parties for any transactions.

1.5. To reduce the risk of fraudulent transactions when visiting countries with a high level of fraud

(countries in Africa, countries in Southeast Asia, countries in Latin America

, Moldova, Ukraine, Turkey, USA), carefully observe

all security measures set out in this Leaflet.

1.6. Keep receipts confirming payment for goods and services for a year from the date

of the transaction with the Card. If the transaction, for any reason, did not take place,

keep receipts for unsuccessful transactions using the Card and / or alternative payment

(cash payment using another Card), if any.

These documents may be required to confirm the legitimacy of the transaction,

made using the Card, or to resolve disputes.

1.7. Regularly (at least once a month) check your payment account statements. If you have any questions related to transactions performed on account

(unauthorized write-offs or erroneous accruals),

, immediately contact the branch of RSK Bank OJSC (hereinafter referred to as the Bank).

1.8. To ensure control over transactions using the Card, you can

use the “SMS notification” service. With the help of this service, you can

receive information about the available balance after making transactions on the Card,

notifications about the receipt of funds to the account and debit transactions on the account.

The service is activated at the Bank’s ATMs.

1.9. To minimize financial losses from fraudulent transactions on

of your Card, you have the opportunity to set limits on the amount of transactions from

Card (for each transaction, for transactions within 24 hours), both separately for transactions

non-cash payment for goods (works, services) and/or cash receipt transactions

, and for all transactions. For the same purpose, the Bank may set

For the same purpose, the Bank may set

restrictions on cash withdrawals from ATMs during the day.

1.10. Upon receipt of any requests (by e-mail, telephone and otherwise) with a request to confirm personal data and information about your Card, do not transfer

information on your Card (PIN code, Card number, Card expiration date,

CVV2 – security code), as these messages are used by

intruders in order to obtain confidential information for subsequent use in

fraudulent purposes. Be careful: messages may look like real

official messages (may have the style of a business letter, contain links to

active sites or sites well disguised as sites of well-known organizations,

information can be carried out automatically using

“electronic voice”), and can also transmit malicious programs that are

computer viruses that allow you to illegally obtain personal

information. Upon receipt of such messages (requests), immediately contact the Bank’s call center on

by phone. For informational interaction with the Bank

For informational interaction with the Bank

, use the means of communication (telephones/faxes, regular and e-mail), the details of which are specified in the documents received directly from the Bank.

1.11. For safe use of Internet resources, use the addresses

of official websites. These measures are connected with the appearance on the Internet of Web-sites imitating Internet representatives of the Banks of the Kyrgyz Republic. The domain names

(addresses where the company offers services on the Internet) and the style

of these sites are usually similar to the names of the original Bank Web sites.

The use of such details is risky and may result in

undesirable consequences (including financial losses). In case of

self-identification of a false website of the Bank or receipt of information of this kind

by e-mail or otherwise, immediately contact the Bank’s call center by phone

(312) 65-03-85 or 65-02-73.

1.12. Update your contact details so that the Bank has the opportunity to contact you by phone/e-mail/sms, for example, in the event of a suspicious transaction on your card.

2. Precautions when making transactions using the Card

2.1. Make all transactions with the Card in trade and service enterprises only in your presence

. Do not allow employees of trade and service enterprises to take your

Card to another location and do not allow the Card to be lost from your field of vision when

carrying out transactions, since in such cases information from your Card using

special equipment can be copied and used to make a

fake card in order to gain access to your payment account.

2.2. Before signing the check, make sure that the document correctly

contains all the data on the operation being performed. If you find inaccuracies in the information provided

, refuse to sign and ask to cancel the operation

. In case of cancellation of the operation, you must receive a receipt for the cancellation of the operation.

In case of cancellation of the operation, you must receive a receipt for the cancellation of the operation.

Cards.

2.5. When entering a PIN code during a transaction in a trade and service company

, please note that it is entered on a special device (PIN pad or

via the POS terminal itself) directly connected to the cash register

or POS -terminal. Resist the suggestion to enter the PIN code twice on

different devices in the same place, except in cases of repeated payment

or cancel the operation.

2.6. Please note that an employee of a bank or a trade and service company

, when carrying out a transaction with the Card, has the right to demand a document

proving your identity.

2.7. The Card may be confiscated from you at the request of the Bank by an employee of the bank or trade and service enterprises

where you pay for goods/services using the

Card. In this case, you must definitely obtain an act of withdrawal of the Card and

immediately contact the Bank to block the card.

2.8. Do not forget to collect the Card after the transaction, making sure that

the returned Card belongs to you.

2.9. Present the Card for payment only in those trade and service companies that

inspire confidence. Take special care when carrying out transactions with

using the Card in the following trade and service organizations:

••Leisure centers

••Jewellery shops

••Travel agencies

••Internet services (booking tickets, paying for goods/services, booking hotels, etc.)

Particularly important to remember about this while traveling in Eastern Europe,

Asia-Pacific region, in countries with a high level of fraud, indicated

in paragraph 1.5.

2.10. To minimize the risks of your Card, refrain from receiving cash

cash in trade and service enterprises, which, in addition to selling goods,

cash out. Use for these purposes cash points or ATMs located in safe places (bank divisions,

government agencies, large shopping malls, hotels, airports, etc. ).

).

2.11. Before carrying out a transaction at an ATM / self-service terminal

inspect its appearance. When suspicious devices are detected (overlay on the card reader, overlay on the keyboard for entering a PIN code, overlay on the front side of the ATM or next to it, into which a camera can be mounted, etc.), wires and foreign products do not insert the Card into the reader. If possible, contact the organization that installed the ATM / self-service terminal to report any suspicious devices found.

2.12. In order to prevent fraudulent transactions and in accordance with the recommendations of international payment systems, the Bank installs special typical blue overlays on ATMs to avoid unauthorized copying of magnetic track data of cards. If there is information on the ATM screen about the

appearance of the anti-skimming pad for additional security

, compare the appearance of the existing pad with the proposed image.

If there is a discrepancy, contact the call center by phone.

2.13. If you notice suspicious people near the ATM, it is recommended

to carry out the operation at another ATM installed in a well-lit and safe place

, or at a cash dispensing point.

2.14. We draw your attention to the following: payment card reader for

providing access to special closed premises where ATMs and

other self-service terminals, should not require a PIN. If a device requiring a PIN code is installed when entering the premises

, do not use it.

2.15. When performing an operation with entering a PIN code, make sure that the PIN code entered on the

keypad is not visible to others, for this, for example, close the keypad with your other hand

to avoid the possibility of video recording your actions and view

information about the PIN being entered. side code. Do not resort to the help of strangers

when conducting transactions with Cards.

2.16. If your Card is seized by an ATM/self-service device due to

technical problems, immediately contact the Bank serving the ATM/self-service device

for more information, when and where

you can receive the Card. It is recommended to temporarily suspend the Card (temporarily block the Card on

It is recommended to temporarily suspend the Card (temporarily block the Card on

) by contacting the Bank’s call center by phone.

2.17. In case of non-receipt of all or part of the requested amount at an ATM or

problems during the investment transaction (on devices with the

cash acceptance function), contact the Bank to fill out an application about

the problem that has arisen.

• In cases where you think that your PIN code has become known to strangers,

you have suspicions of illegal use of your Card, the Card was

is lost, stolen or seized by an ATM, you should immediately contact the Bank’s Call Center on

, or personally contact the Bank with a request on

to block the Card and order a new Card.

3. Security measures when making non-cash payment for goods (works,

services) via the Internet, telephone / fax, mail.

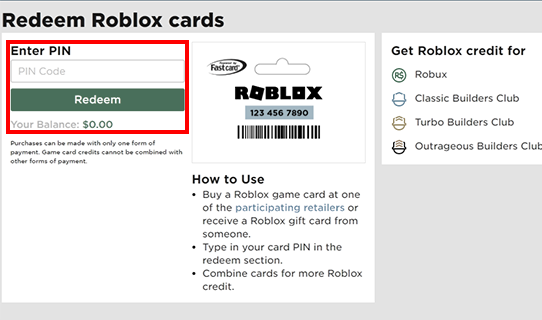

3.1. When carrying out non-cash payment for goods/services via the Internet, telephone/fax, mail, you may be asked to indicate CVV2 (three digits of the security code). This value is located on the reverse side of the Card (the last three

This value is located on the reverse side of the Card (the last three

numbers printed on the signature strip or to the right of it in a special field) and

serves for additional verification of the client by the Bank.

3.2. Entering the PIN-code to identify the Holder is supposed only when carrying out transactions with the Card

in the presence of the Holder at terminals with the function of reading card data

and only with the help of a special device – a PIN-pad: a keyboard connected to a payment terminal or a cash register

apparatus. In case of

non-cash payment for goods / services via the Internet, telephone / fax,

mail should exclude the provision of information about the PIN code.

3.3. When carrying out transactions in online stores, check that the store has published

obligations for the protection of customer data, is certified by the VISA payment system

, and the website contains the contact details of the organization. If possible,

If possible,

make sure that the address and phone number listed on the website are correct. Enter required

data must be transmitted in a secure channel using the HTTPS protocol.

3.4. Be careful, Web sites can be used by fraudsters to obtain confidential information

(to order a product/service, customers are asked to fill out electronic forms

and indicate the details of payment accounts, cards, including a PIN code).

There are, for example, such types of fraud as the twin site of a well-known Internet store;

; “One-day shop”; a site that represents a real non-existent

organization, etc. Be careful when conducting transactions via the Internet

and providing your personal information and information about

your Cards.

3.4. In order to avoid fraud on your payment card, the Bank advises you

after using the Payment card in one of the following countries to apply to the Bank for blocking or reissuing your card to a new card:

•Thailand

•Malaysia

• TELEVEN

• Grazia

NOKCONG

• Indonesia

• Singapore

imes

Nonigeria

• imes

• · Durability

should be remembered:

•The Bank is not responsible for transactions made on fraudulent sites.

•The Client is responsible for all transactions made with the Card (including

Internet transactions) performed using the card details, as well as for

all amounts debited from the client’s account.

•The customer bears all risks associated with Internet transactions.

•The Bank is not responsible if the transaction fails due to circumstances beyond the Bank’s control

.

FAQ

How long does it take to make a card?

The personalized card is provided to the holder within 5 working days from the date of receipt by the Bank of a duly completed application. For a fee, the Bank provides the possibility of urgent production of bank cards within 24 hours.

How many times can you enter an incorrect PIN code?

An incorrect PIN code can be entered no more than 3 times, after the 3rd attempt the card will be blocked.

What should I do if I have forgotten my PIN?

It is necessary to issue an application for reissuing a bank card with a new PIN code at any branch / branch of the Bank. It is impossible to issue a new PIN or “repeat” the old one without reissuing the card.

It is impossible to issue a new PIN or “repeat” the old one without reissuing the card.

What should I do if I have lost my card?

If you have lost your card (or it has been stolen from you), immediately report it to the Bank by calling the round-the-clock support service +7 (495) 785-15-15 and 8-800-200-30-22 and block the card. Any notice of the loss of the card must be confirmed by a written application issued in any branch / branch of the Bank in the prescribed form.

Upon discovery of a card previously declared lost, the holder is obliged to immediately notify the Bank and follow the Bank’s instructions. A card declared by the owner as lost is not subject to unblocking after the Bank receives a written application about the loss of the card.

What to do if the card was seized by an ATM?

Immediately notify the Bank about this by calling +7 (495) 785-15-15 and 8-800-200-30-22. The card will be blocked until received by its owner. Upon receipt of the card, the holder must unblock the card by submitting an application for unblocking at a branch of the Bank.

Upon receipt of the card, the holder must unblock the card by submitting an application for unblocking at a branch of the Bank.

Is it possible to set a limit on individual cards and how to do it?

Yes, the main account holder can set or change the limit for each additional card by issuing a corresponding application at the branch / branch of the Bank. The limit can be set for receiving cash and for paying for goods and services in trade and service enterprises.

Is it possible to find out the balance of my account without coming to the Bank branch, for example, by phone?

You can, and not just by phone. The bank offers you several ways of self-service:

- Internet banking. Being in any country of the world and having access to the Internet, you can fully control your accounts with the Bank, including finding out the account balance.

- CALL-center services. You can find out the current state of the account, the last movement of funds on the account, the receipt of funds to the account for the period, the expenditure of funds from the account for the period and other useful information.

- ATMs. You can find out the balance of your account, information about recent transactions.

How to replenish a bank card account?

The client can top up the card account at the branches / branches of the Bank:

- at the cash desk if you have a plastic card with a Russian passport;

- through the Bank’s economist in the absence of a plastic card with the presentation of a Russian passport and card number;

- by transfer from an Account opened with another Bank.

The card account can be replenished not only independently, but also through relatives, friends, partners. The currency account is replenished only if there is a notarized power of attorney.

Are Bank cards with a dollar account accepted for payment in Moscow?

Certainly. It doesn’t matter what currency your account is in.

Can I use the ruble card abroad?

Undoubtedly. You can use this card wherever the cards of this payment system are serviced.

You can use this card wherever the cards of this payment system are serviced.

What should I do if I find transactions on the card statement that I did not perform?

Immediately block the card by calling +7 (495) 785-15-15 and 8-800-200-30-22 around the clock. Then notify the Bank of the incident in writing.

What should I do if someone paid for an online purchase with my card without my knowledge?

In this case, you must fill out the appropriate dispute form. This can be done at any branch of the Bank. Unauthorized write-offs will be investigated.

Since the card number has become known to third parties who may continue to use it in a similar way, it is advisable to reissue the card.

Is it possible to transfer money to an account to which a plastic card has been issued?

Undoubtedly. This account is a full-fledged Current account, and all operations on it are carried out in the usual manner. However, be careful when receiving funds from abroad – not all funds received from abroad can be credited to a card account.

However, be careful when receiving funds from abroad – not all funds received from abroad can be credited to a card account.

What should I do if I paid for the stay in cash when I checked out of the hotel, but the amount of the initial deposit is still blocked on the payment card?

Usually, when you check out, the hotel must give instructions to release the amount of the deposit, but quite often this does not happen. In this situation, you need to contact any of the Bank’s departments and fill out the appropriate application for unblocking the amount, attaching a copy of the receipt for paying for the hotel room.

What to do, I rented a car abroad, paid in cash when returning the car, and the amount of the initial deposit on the card was not unlocked?

In this situation, as well as when checking into a hotel, you need to contact any of the Bank’s divisions and fill out the appropriate application for unblocking the amount, attaching a copy of the car rental receipt.

What should I do if I paid for the goods using a bank card and discovered that the same amount was debited from the card account twice?

You need to contact any of the Bank’s divisions and fill out the appropriate dispute form, attaching a copy of the payment receipt. Unlike the unblocking of the amount, the protest procedure is quite lengthy.

What should I do if the product was returned with a check for a refund, but the money was not credited to the account?

Credit checks can take up to 30 days to repay. In the event that after this period the crediting of the card account has not occurred, you need to contact any of the Bank’s divisions and fill out the appropriate dispute form, attaching a copy of the credit check.

ATM did not dispense the requested amount/disbursed partially

This situation may arise due to a technical malfunction of the ATM or a temporary lack of communication with the Bank servicing this ATM. You need to contact any of the Bank’s divisions and fill out an application. If you tried to withdraw cash from an ATM that is not part of the ATM network of IIB DALENA LLC, then you need to fill out the appropriate dispute form.

You need to contact any of the Bank’s divisions and fill out an application. If you tried to withdraw cash from an ATM that is not part of the ATM network of IIB DALENA LLC, then you need to fill out the appropriate dispute form.

What should I do if the card is withdrawn from a merchant or bank?

If your card is seized in a trade and service company or in a bank, ask for a written statement of seizure indicating the date, time and reason for the seizure, as well as the signature of the employee of the enterprise / bank who seized the card. Make sure that the card is cut in your presence in order to exclude its unauthorized use. Next, be sure to contact the Bank by round-the-clock phone +7 (495) 785-15-15 and 8-800-200-30-22.

Is it necessary to declare plastic cards when crossing the Russian border?

By itself, a plastic card is not a monetary asset and therefore is not subject to declaration when crossing the Russian border. If a plastic card is found in your possession (for example, during a personal search), customs officers are not entitled to require you to declare the amount or amounts available on your account or accounts in the bank that issued the card.

If a plastic card is found in your possession (for example, during a personal search), customs officers are not entitled to require you to declare the amount or amounts available on your account or accounts in the bank that issued the card.

Thus, the current limit on the undeclared amount when crossing the border does not apply to plastic cards, and abroad you are free to spend all your funds at your discretion.

What is the additional CVV2 card security code?

The CVV2 code is protection against fraudulent transactions in which the card itself is not provided or the card details are entered manually by the cashier (for example, booking a hotel, paying for goods and services on the Internet, ordering goods and services by phone). The code (3 digits) is applied on the back of the plastic card.

The CVV2 code must be used when making payments via the Internet. If the online store did not request the CVV2 code from the payer, the Bank has the right to refuse payment by card.

I’m going on a business trip, can I give my card to my wife so she can withdraw money from my account?

The holder of the main card does not have the right to transfer his card to another person (even a relative). If an “abnormal” situation occurs with your card: the magnetic strip is demagnetized, the card is lost or seized by an ATM, etc., the Bank will not be able to help your wife in any way, and she will be left without money until you return.

In such a case, we recommend that you order an additional card from the Bank in the name of your wife (or another person whom you allow to use the account). The card will then be linked to your card account. In turn, you can limit the use of funds by setting a limit on the card for receiving funds and / or paying for goods and services.

I received a “salary” card at the enterprise, and now I quit. Do I need to return the card to the Bank?

After leaving the enterprise, you must apply to the Bank and hand over the card, write an application for closing the account and receive the balance in cash after the time established by the Rules of the Bank.