Usa pin number: Free zip code finder & lookup by State, City & Address

How to create a pin number & tips to remember it

Forgetting PINs happens more often than you might think. Here are some pointers for creating and remembering an effective PIN.

If you can’t remember your Personal Identification Number (PIN), accessing your bank account can be difficult and cause unnecessary inconveniences in daily life. Fearing hackers or identity thieves, people often make PINs more complicated than necessary. Avoid the hassle with these eight tricks and tips.

1. Avoid the obvious

Make your PIN less easy to guess by avoiding obvious number combinations or sequences such as “1111,” “1234” or “9876.”

2. Use the word method

Some people find it helpful if they think of their PIN number as a word. View it as if you were dialing it on a landline phone, with each number from 2 to 9 representing three or four letters. The word “ball,” for example, would be “2255.” For many people, it’s easier to remember “ball,” which leads to recalling the numbers associated with it. If you use this method, it’s best to use as uncommon a word as possible so that it is unlikely to be guessed by someone else.

If you use this method, it’s best to use as uncommon a word as possible so that it is unlikely to be guessed by someone else.

3. Try a familiar date

A memorable date, such as a birthday or anniversary, can make a handy PIN. If a loved one was born Sept. 3, 1986, “9386” is a relatively easy PIN for you to remember while remaining obscure to fraudsters. The only potential downfall to this method is that the date you choose may be predictable for people who know you well or have access to your personal information.

4. Use a meaningful address

A house number can be a good choice, especially if it’s an address you won’t forget but others are unlikely to know. Your best bet: use the four-digit street address of a childhood friend, a former workplace or another significant place. Numbers with personal significance are easy to remember and hard to guess. Note: Avoid using your own address since thieves could access this information.

5. Try an extra-long PIN

Try an extra-long PIN

If your bank allows it, you can also create a more elaborate, lengthy number. An 8- or 12-digit PIN is more secure than a traditional 4-digit number, but it’s also harder to remember, unless it is already in your memory. Do you still remember the phone number to your childhood home? Maybe you do but would-be thieves probably don’t.

6. Fake a friend

If you simply can’t remember your PIN without writing it down, you can hide it in the name or number of a contact within your phone. Make sure your phone is password-protected and remember to call your bank immediately to reset your PIN if your phone gets lost or stolen.

7. Don’t write it down

It’s better to forget your PIN than to write it down. If you need to have it written down in order to remember it, you’re going to have to bring it with you. That makes others nearby as likely to see it as you are.

8. Use different secure PIN numbers for different accounts

Having different secure PIN numbers for each of your important accounts reduces risk so they can’t all be immediately accessed if one secure PIN is compromised. However, you still need to be able to remember them all.

However, you still need to be able to remember them all.

If you forget your PIN, immediately get in touch with a bank representative, either on the phone or by stopping into a branch. Never email your PIN to anyone. If you suspect your card or PIN has been lost or stolen or your account has been otherwise compromised, call your bank immediately.

Protecting your personal information is important. Learn more about identity protection.

Everything You Need to Know About Chip and PIN Credit Cards

Bankrate logo

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict

,

this post may contain references to products from our partners. Here’s an explanation for

.

The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

Paying for purchases with a rewards credit card has always been convenient, but you may have noticed some substantial changes in how your card is processed over the years. For example, where we once “swiped” our credit cards in a payment terminal to make a payment, we are now asked to insert our credit card—or “dip” our card—instead. In some cases, you may even be able to “tap to pay” with your credit card, which involves holding it next to the terminal so your card information can be accurately read.

In any case, the main driving force behind these changes is technology, including the introduction of chip and PIN credit cards. This guide explains everything you need to know about chip and PIN credit cards, how they work and why you may want to begin using them.

How do chip and PIN cards work?

Chip and PIN cards are named after three major credit card networks across the world—Europay, Mastercard and Visa (EMV)—and were first introduced in Europe in 1993.

Chip and PIN cards were developed as a way to reduce point-of-sale credit card number theft and skimming cybercrimes. And, as of Oct. 2015, all U.S. merchants were mandated to accept EMV cards or face potential liability for any credit card fraud originating at their establishment.

And, as of Oct. 2015, all U.S. merchants were mandated to accept EMV cards or face potential liability for any credit card fraud originating at their establishment.

But, how do chip and pin credit cards work exactly? Instead of using the magnetic stripe on the side you once used to make a purchase, chip and PIN credit cards have a small metallic chip on the front that holds your payment data. This metallic chip is designed to reduce fraud, and it does so by providing a unique code for each purchase you make. Because the security code is unique for every purchase, it’s significantly more difficult for a thief to use your card for the purpose of fraud.

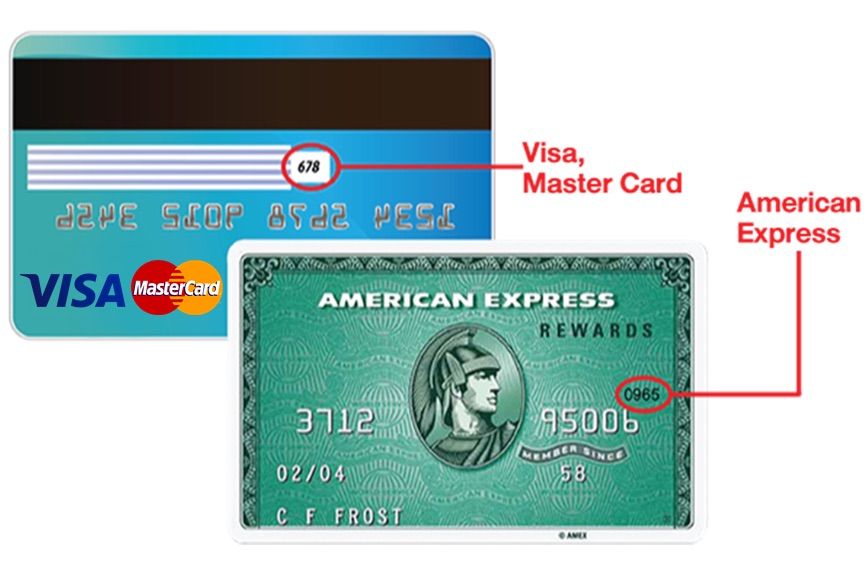

What is a credit card PIN?

A credit card PIN—also known as your personal identification number—is a four-digit code you can use to verify you are the person making a purchase with your chip and PIN credit card. You can pick your own PIN when you sign up for a chip and pin credit card, and you can also change your PIN at any time.

With a unique PIN that nobody but you knows, your transactions should be even less susceptible to fraud. After all, it’s fairly easy to forge a signature and walk away with merchandise at a payment terminal, yet hackers and thieves will have a difficult time guessing a four-digit code. Your chip credit card might not automatically come with a pin.

Can I get a PIN for my credit card?

Most credit cards with chip technology issued in the U.S. are considered “chip and signature” cards. This type of credit card comes with the added fraud protection of chip technology, yet you’ll be asked to provide a signature instead of a PIN when you use your card for purchases.

Some credit card issuers offer PIN capacity as well, meaning you can add a PIN to your card that doesn’t already have one. But if you want this added layer of protection, it’s up to you to call your card issuer to inquire.

Are chip and PIN credit cards safe?

Chip and PIN credit cards are significantly safer to use than their outdated magnetic stripe counterparts. This is due to the unique, encrypted code that is generated each time you initiate a transaction. This code allows your actual credit card number to remain concealed and makes any data derived from thieves during a transaction absolutely useless.

This is due to the unique, encrypted code that is generated each time you initiate a transaction. This code allows your actual credit card number to remain concealed and makes any data derived from thieves during a transaction absolutely useless.

However, consumers should keep in mind that credit card transactions are already “safe” in terms of their liability. The Fair Credit Billing Act (FCBA) sets a limit of $50 in total liability for fraudulent credit card transactions made with your card, and liability is set at $0 for fraudulent transactions made with your card number. On top of that, the majority of credit cards have zero fraud liability policies that ensure you won’t pay a dime for purchases you didn’t make.

If someone uses your credit card or card number for fraudulent purchases, all you have to do is call your card issuer and report the fraud. From there, the fraudulent transactions are wiped from your account, and your issuer will take over the investigation from there. Additionally, you’ll be sent a new physical credit card, as well as a new account number to use.

Additionally, you’ll be sent a new physical credit card, as well as a new account number to use.

Best credit cards with chip and PIN security for 2022

If you like the idea of having the best credit card security features out there, it’s smart to take a closer look at credit cards that have chip and PIN technology. Here are Bankrate’s top chip and PIN credit cards for 2022:

Chase Freedom Unlimited: Best overall

If you’re looking for a no-annual-fee chip and pin credit card, the Chase Freedom Unlimited® is hard to beat. With this Chase credit card, you’ll earn 5 percent cash back on travel purchased through Chase Ultimate Rewards, 3 percent cash back on dining, 3 percent cash back on drugstore purchases and 1.5 percent back on all purchases. If you frequently utilize rideshare services, you’ll get 5 percent cash back on Lyft purchases through March 2025. In the first year, you’ll earn an extra 1.5 percent cash back on everything you buy (on up to $20,000 in the first 12 months). That’s 6.5 percent on travel purchased through Chase Ultimate Rewards, 4.5 percent on dining and drugstores, and 3 percent on all other purchases.

That’s 6.5 percent on travel purchased through Chase Ultimate Rewards, 4.5 percent on dining and drugstores, and 3 percent on all other purchases.

Blue Cash Everyday Card from American Express: Best for groceries

The Blue Cash Everyday® Card from American Express is another no-annual-fee chip and pin credit card that lets you earn cash back on grocery purchases and other bills. This cash back credit card comes with a welcome bonus of $200 back after you spend $2,000 in purchases on your new card within the first six months of card membership. You will receive cash back in the form of statement credits.

You can also earn 3% cash back at U.S. supermarkets, U.S. gas stations and U.S. online retail purchases on up to $6,000 per calendar year in purchases in each category (then 1%), and 1% cash back on other purchases.. Just keep in mind that cash back earned with this card can be redeemed for statement credits to your account.

Bank of America Premium Rewards credit card: Best for travel

The Bank of America® Premium Rewards® credit card charges a $95 annual fee, yet the rewards and perks you receive can make it a good investment. You can start off earning 50,000 online bonus points ($500 value) when you spend $3,000 on your card within the first 90 days of account opening. You’ll also earn 2X points per $1 spent on travel and dining and 1.5X points per $1 spent on all other purchases. Additional benefits you can enjoy with this travel credit card include up to a $100 airline incidental credit each year, up to $100 in Global Entry or TSA Precheck credits every four years and no foreign transaction fees.

You can start off earning 50,000 online bonus points ($500 value) when you spend $3,000 on your card within the first 90 days of account opening. You’ll also earn 2X points per $1 spent on travel and dining and 1.5X points per $1 spent on all other purchases. Additional benefits you can enjoy with this travel credit card include up to a $100 airline incidental credit each year, up to $100 in Global Entry or TSA Precheck credits every four years and no foreign transaction fees.

The bottom line

Chip and PIN technology may be fairly new in the world of credit cards, but it is definitely here to stay. However, you should take the time to compare the top chip-and-pin and chip-and-signature rewards credit cards since their benefits can vary. With some research, you can wind up with a credit card that has the best security features and the rewards and perks you want the most.

The Russians were told how to properly store the PIN code from the card 01:00+03:00

2023

https://1prime. ru/exclusive/20230207/839704289.html

ru/exclusive/20230207/839704289.html

The Russians were told how to store the pin code from the card

Exclusive

News

RU

https://1prime.ru/docs/terms/terms_of_use.html

https://russiatoday.rf

Now various banking technologies have appeared that make it possible to pay for purchases without entering a security card code, but the pin code is still the key to the customer’s account in… PRIME, 02/07/2023

exclusive, finance, news, pin- code, jet infosystems, alexey sizov

https://1prime.ru/images/83303/76/833037611.jpg

1920

1440

true

/638.ru /833037611.jpg

https://1prime.ru/images/83303/76/833037605.jpg

1920

1080

True

https://1prime.ru/images/83303/76/833037605.jpg

https://1prime.ru/images/83303/76/833037602.JPG 9000 920

1920

True

https://1prime.ru/images/83303/76/833037602.jpg

https://1prime.ru/exclusive/20230203/839670178. html

html

agency of grade

. 1

5

4.7

96

7 495 645-37-00

FSUE MIA “Russia Today”

https: // Russian-Russian.rf/Awards/

Economic Information Prime Information

1

5

4.7

9000

7 495 645-37-00

FSUP FSUP MIA “Russia Today”

https: // Russian Sawdom.rf/Awards/

Economic Information Prime

1

5

4.7

9000 9000 9000

7 495 645-37-00

FSUI MIA “Russia today”

https: // Russian-ears.rf/awards/

: // Rossiyazyazhodnya.rf/Awards/

Elena Gurinovich

https://1prime.ru/images/82942/26/829422698.jpg

Exclusive

“The pin code is one of the most important details for confirming card transactions, which means that its storage should be as safe as possible,” the expert noted.

In his opinion, the ideal option is to remember the password from the card. It is better to store a pin envelope where important but rarely used documents are stored. For example, diploma, marriage certificate and so on.

“If it is difficult to remember, store it so that the loss or theft of the card does not lead to the theft of the pin code,” he noted and added that in no case should you put the card and the code from it in one place (for example, in a purse or bag).

If you assign PIN codes yourself, it is better not to use simple combinations, memorable years or dates, Sizov concluded.

Payment without a PIN: what are the limits for contactless payments in the world

Prepared an overview of the limits for contactless payments in different countries of the world

Photo: pexels.com

Contactless, as you know, we call payments that are made either using cards or through mobile applications and digital wallets. The payment operation is only possible at a distance of two to four inches (4 cm), which ensures that the decision to withdraw funds is targeted.

The most popular and commonly used types of contactless payments are contactless debit and credit cards. Inside, they contain a small antenna that provides wireless communication with the reader. These cards typically have a magnetic stripe and a chip, so they can be used in more traditional ways if the store doesn’t have an appropriate card reader. Other popular contactless payment methods are mobile apps. They allow you to replace a credit or debit card. To use them, you need to enable contactless payment on your smartphone, download the necessary applications, link cards and accounts.

Depending on your bank or the country you are in, there may be a limit on the amount you can spend on a transaction without entering a PIN. In general, such a limit, on the one hand, can be perceived as a complication of the ease of use of contactless payments. However, it increases the level of security, because thanks to this, a fraudster will not be able to spend too much from your account. Contactless payment limits vary from country to country. The authorities and financial institutions set their own limits. Many European countries have announced an increase in contactless restrictions in response to the spread of COVID-19. Let’s take a closer look at these limits.

Photo: pexels.com

UK

Contactless cards appeared in England in 2007. During this time, the payment limit gradually increased from £10 to £100. The decision to raise the bar to £100 was made by the Treasury and the Financial Comptrollership Authority (FCA) in October this year in response to the increased use of contactless payments amid the pandemic. The authorities hope this will make this form of payment attractive, facilitate social distancing and help avoid human contact with potentially contaminated items. Meanwhile, digital banks Starling and Lloyds Bank allow their customers to set their own contactless limit.

The authorities hope this will make this form of payment attractive, facilitate social distancing and help avoid human contact with potentially contaminated items. Meanwhile, digital banks Starling and Lloyds Bank allow their customers to set their own contactless limit.

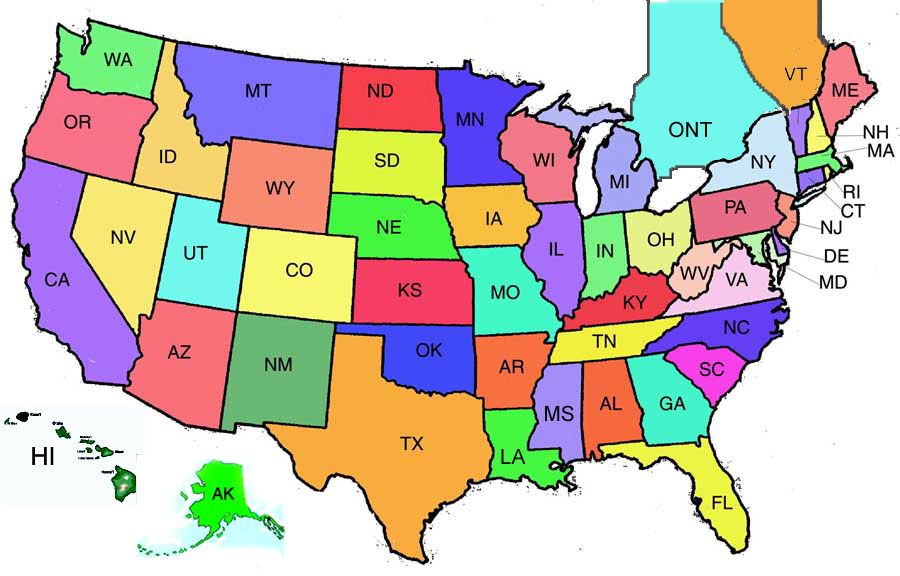

North America

Neither the US nor Canada set contactless limits, leaving them up to financial institutions. For example, in the US, Visa, Mastercard, and Discover have set their limits at $100, and American Express at $200. In Canada, Mastercard, Visa and American Express fixed the limit at CAD 250, while Interac fixed it at CAD 100.

France

The French Banking Federation (FBF) has raised the limit from 30 to 50 euros due to the pandemic. At the same time, according to some studies, 37% of French consumers believe that the restriction should be lifted altogether.

Ireland

In 2020, the limit for contactless card payments in Ireland has increased to 50 euros. Previously, owner authentication was not required for purchases up to 30 euros.